The second half of December is typically bullish for the SPX

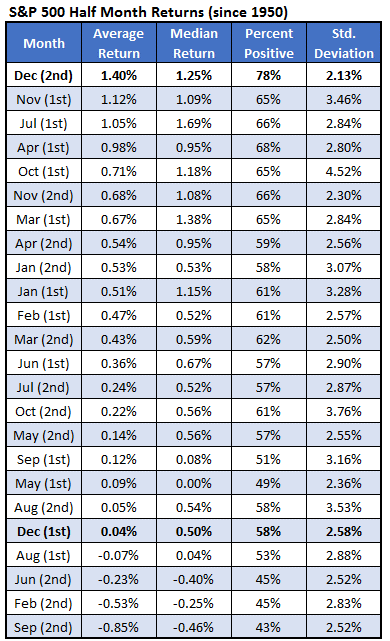

December is one of the more interesting months when it comes to stock market seasonality. The table below summarizes the monthly returns for the S&P 500 Index (SPX) going back to 1950. December is a historically excellent month for stocks, ranking second behind April for average return, and first for the percentage of positive returns. The positive returns, however, were concentrated in the second half of the month, which is shown in the next section. I will also investigate the impact of November’s performance on December’s seasonality. Anyone paying attention knows that the SPX is in the midst of a very strong November performance.

The 2 Halves of December

The next table summarizes SPX returns by the half month. The first half of December ranks 20th out of the 24 half months going by average return. The second half of December, however, was the best half month of the year. It has the highest average return, the highest percentage of positive returns by 10% (78% vs. 68% for the next highest), and the lowest standard deviation of returns. Based on this, you’re not missing out on December by waiting a couple weeks before buying.

SPX Up Big in November

With just a few more days of trading left, the SPX is up over 8% so far this November. I broke down December returns since 1950 when the broad-market index gained over 5% in the preceding November. The contrast in the first and second half of the month was more pronounced in these situations. There were 13 instances of November gaining 5% or more. The first half of December averaged a loss of more than 1%, with only 46% of the returns positive. The second half of the month outperformed its typically strong return, gaining on average 1.68%, with 85% of the returns positive. Based on this, it might be better to wait a couple weeks before taking advantage of the Santa Clause rally.