Eva-katalin | E+ | Getty Images

It is common folklore, a fairy tale of sorts, that middle-class Americans received perpetual relief in the Tax Cuts and Jobs Act of 2017.

First, property taxes generate 32% of state and local income, and U.S. median single-family home property taxes have risen by more than 25% since 2019. There are also under-the-radar excise taxes imposed on the sale of things like fuel, airline tickets, tires, tobacco and other goods and services that can mitigate some of the savings from many of the federal tax cuts that are temporary and may disappear after 2025.

The devil is usually in the details, and by all accounts he’s been busy.

The provision that reduced the corporate tax rates to 21% is permanent, but the qualified business income deduction enjoyed by many small businesses, as well as the increased standard deduction and favorable tax brackets, will expire unless Congress extends these deliverables.

More from CNBC’s Advisor Council

Capitol Hill might very well grandfather in these tax cuts, although it’s worth noting that doing so would cost $288 billion in 2026 alone, according to the Institute on Taxation and Economic Policy and $2.7 trillion from 2024 to 2033, per the Peter G. Peterson Foundation.

Meanwhile, Uncle Sam already has his own money problems, slated to have 31% of the debt held by the public, or $7.6 trillion, coming due in 2024 at much higher rates. To add context, the United States will spend more on interest payments than it does on the military this year.

Congress will be motivated to etch all the tax cuts in stone, but it would only add fuel to the debt bonfire.

What tax changes may be on the horizon

If a divided Congress fails to make amendments, the old tax brackets will return after years of wage growth — which means more of your income may hit the older and more onerous brackets sooner.

There is also the once-unlimited state and local tax deduction that the legislation capped at $10,000, the personal exemption which was eliminated, the deduction for unreimbursed business expenses, a deduction for moving, interest on a home equity loan, a deduction for uniforms and a deduction for theft and catastrophic damage from an environmental event that are no longer available. It is currently unclear if these provisions will be returned to taxpayers.

There is also the qualified business income deduction that offers a 20% tax break for small businesses provided they are below certain income thresholds. That deduction is set to expire, a concern that has motivated the Chamber of Commerce to lobby on behalf of its constituents. All of this is in addition to crippling cost-of-living challenges from excessive government spending, the well our Treasury would have to revisit to make these tax cuts permanent.

Hope Congress fixes the problem, or look for a solution

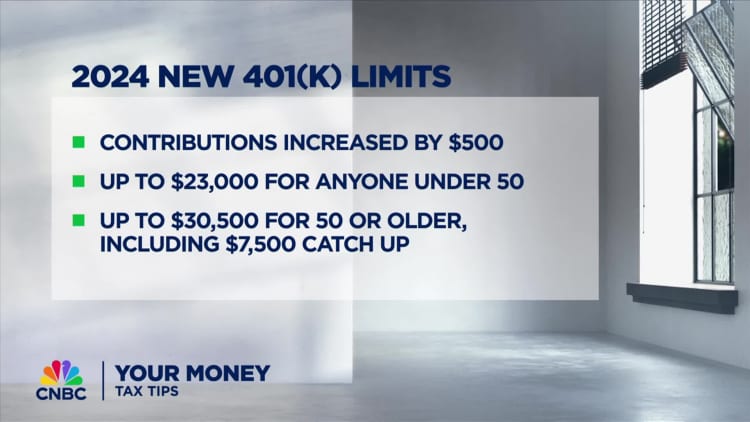

The easiest course of action for everyday Americans is to increase contributions to their pretax retirement plans such as a 401(k), which will reduce federal and state tax exposure dollar for dollar. Once distributions are taken, however, they will be subject to regular income taxes at a time when entitlement expenses have accelerated, and the Treasury will have fewer workers paying for more retirees.

A Roth 401(k) plan may protect against future taxes but does little for current exposure and is subject to legislative risk by both the federal and state governments saddled with unfunded liabilities and pension obligations. While political obstacles make this an unlikely outcome, the math may force officials to write legislation that taxes distributions through means testing or another measure that suits their fiscal needs.

Real estate offers some reprieves because you may be able to depreciate the property over its lifetime. For instance, the IRS allows property owners to deduct 3.64% of the original purchase price for 27 years. A property purchased for $500,000, therefore, offers an estimated $18,200 annual deduction to offset any income received.

Interest rates have made real estate much less attractive. But it’s worth noting that upon the owner’s death, whatever the property value is at the time of death becomes the new cost basis — the value used to determine how much the owner can depreciate — and the beneficiaries can begin depreciating all over again at the higher value for another 27 years.

Another option is permanent life insurance. The media and financial literacy pundits have spent years highlighting the high commissions and fees associated with whole and universal life insurance policies.

Upon closer inspection, however, these vehicles offer more than a death benefit with no exposure to income taxes and have a savings component that can grow tax-deferred with the market.

Moreover, the policy owner can borrow money against the savings component of the policy, known as the cash surrender value, pay zero taxes and repay the loan with the death benefit when they pass away. Think of it as a Roth individual retirement account without income or contribution limits that pays a death benefit when you die.

Suffice it to say these solutions are viable for some people, yet each household needs a strategy that fits their own unique situation. As appealing as it may sound to reduce your tax exposure, the first call should be to your tax advisor because if you recall, it was the nuances of this legislation that many of us overlooked — namely the fact that the benefits for some were permanent and for others, temporary — that got us into this hot water in the first place.

— By Ivory Johnson, certified financial planner and the founder of Delancey Wealth Management in Washington, D.C. He is also a member of the CNBC Financial Advisor Council.