Designing an optimal retirement income plan for a client is not easy. A myriad of uncertainties and risks must be addressed, directly or indirectly, and a significant body of research exists on the topic. Annuities are products that have been widely regarded among retirement academics and economists for decades. Though adoption of annuities has finally accelerated in recent years, they’re still not widely utilized by financial advisors, and consequently retirees, today.

This article analyzes data from a recent research study to explore how knowledge about annuities among financial advisors could be related to decisions around usage. The results strongly suggest that advisors who are less knowledgeable about annuities are less likely to view annuities favorably, less likely to understand the potential benefits, and therefore not surprisingly, less likely to recommend them. There’s also a perception gap between advisors and their clients — those advisors with low knowledge of annuities don’t think there is interest and therefore demand for annuities from clients, while the data show there is.

CHANGING RETIREMENT PLANNING LANDSCAPE

The Alliance for Lifetime Income just released its 2023 Protected Retirement Income and Planning Study, which surveys consumers and financial professionals. The study examines the changing retirement planning landscape, shifts in consumer and advisor attitudes and behavior towards retirement security, and demands for protected lifetime income.

One clear trend is that the way advisors do retirement plans continues to change, with 78% of respondents using Monte Carlo projections. It’s an important evolution from financial plans based on purely deterministic assumptions since it requires a better exploration and understanding of the risks and uncertainties around retirement. While most financial planning tools only assume returns as the random (i.e., stochastic) variable, longevity assumptions are perhaps just as important, or more.

The survey asked advisors about the longevity planning age they would use for a married couple (male/female) retiring at the age of 65. The average age was 92 with a median of 94. This is likely an aggressive assumption, given the relatively high incomes among households who engage a financial advisor and the corresponding higher life expectancies. More refined mortality tables would suggest there is approximately a 50% probability that one member of this joint household could live to age 95.

Using longevity planning periods that are too short is likely to result in a lower demand for products, like annuities, that explicitly provide longevity protection, despite the widely recognized importance of such strategies among advisors.

ADVISOR PERCEPTIONS

Financial advisors in the survey collectively had a relatively high level of self-assessed knowledge about annuities. The question was, “How knowledgeable are you about annuities that provide guaranteed lifetime income?” with seven potential responses ranging from 1 (not at all knowledgeable) to 7 (extremely knowledgeable). The average score was 5.77, with a median score of 6.

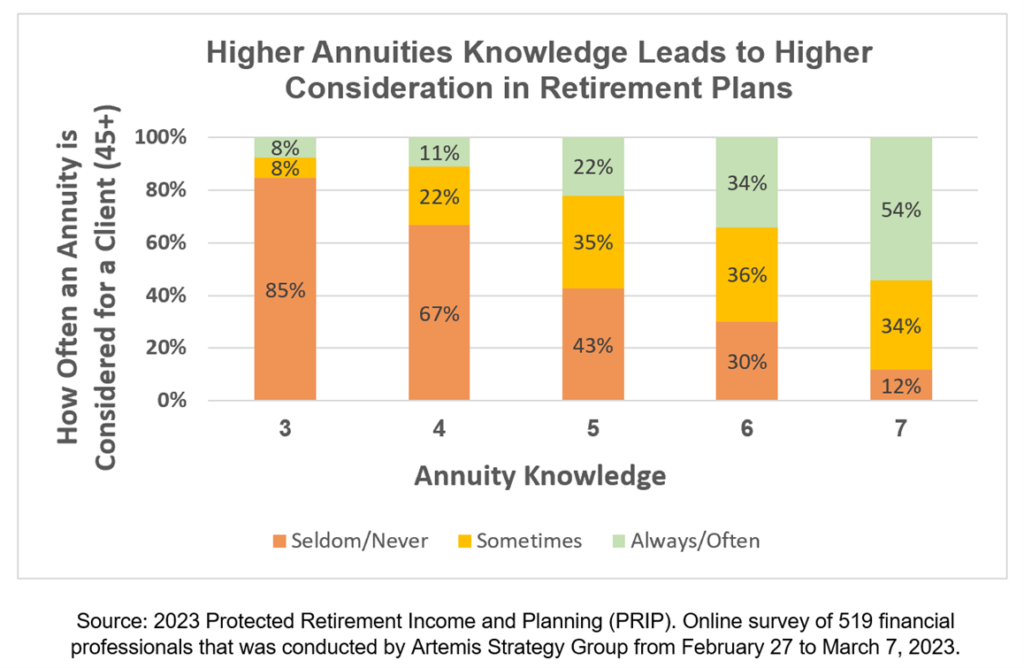

As annuity knowledge increases, so does the perception of these products, as well as the probability of considering them for clients. Seventy-seven percent of advisors with the highest self-assessed level of annuity knowledge had a positive perception of annuities versus 13% of those with relatively low knowledge (defined as a self-assessed score of 4). With respect to advisors considering annuities in a retirement or financial plan for clients over the age of 45, 54% of advisors with the highest self-assessed level of annuity knowledge consider an annuity always or often, versus only 11% among those with relatively low knowledge. The bottom line is that advisors who admit to not knowing much about annuities are also less likely to view annuities favorably and less likely to recommend them to a client.

There is additional evidence in the study that advisors who aren’t knowledgeable about annuities may not understand how they can benefit clients, especially retirees looking for protected lifetime income.

For example, it is widely acknowledged among retirement academics that allocating to annuities can increase retiree spending levels because they eliminate idiosyncratic longevity risk. Planning for a retirement period that could last five years or 40 years reduces spending levels to account for the uncertainty.

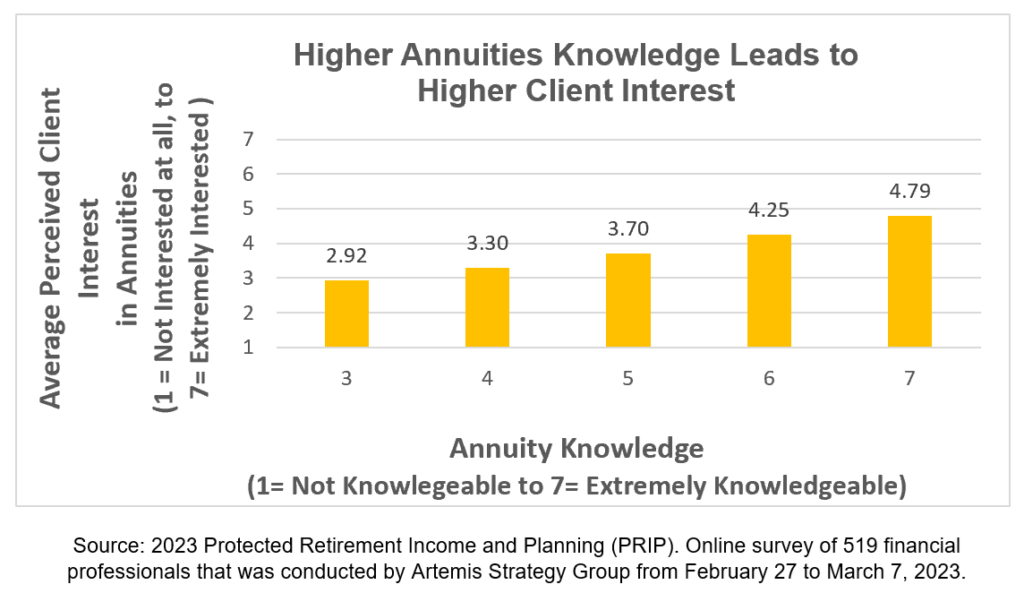

Finally, lack of knowledge about annuities appears even to be related to client perceptions on the interest in annuities. When perceived client interest in annuities is measured on a scale from 1 (not at all interested) to 7 (extremely interested), perceived client interest increases monotonically as annuity knowledge increases. For example, the average perceived client interest is 3.30 for an advisor with annuity knowledge of 4 (the midpoint) versus 4.79 for those with the highest knowledge. In other words, advisors who don’t understand annuities don’t perceive any interest from clients. To some extent this could become a self-fulfilling prophecy, in which the advisor doesn’t believe the client could benefit from an annuity because they don’t understand the potential value and therefore never recommends them.

CONCLUSION

As financial advisors continue to pivot away from providing just investment management services to more comprehensive financial planning services to clients, knowledge and real understanding of retirement income planning strategies and solutions is becoming increasingly important.

Despite decades of research on the many different benefits of annuities, widespread financial advisor interest remains relatively mixed. This data suggest part of the lack of demand among advisors could be related to lack of real understanding of annuities. The need for better financial advisor education about annuities is very likely an important step first step in exponentially growing the use of annuities in retirement income plans today.

David Blanchett is a research fellow with the Alliance for Lifetime Income’s Retirement Income Institute and managing director and head of retirement research for PGIM DC Solutions.