Volume & Velocity

When it comes to loans of this kind, another core component of return is the “upfront economics” of the transaction. This is the structuring fee that the lender receives up front for structuring and completing the transaction. Therefore, higher transaction volume leads to more upfront fees passed on to the investor.

One might intuit that in a period of rising rates, fewer loans are being issued as it costs more for companies to borrow. Lower volume would mean lower upfront fees, and therefore lower expected return. However, research shows that Floating Rate Direct Loan volumes during past periods of rising interest rates have actually increased due to the combination of strong economic tailwinds and investment capital flowing to floating rate opportunities. This is illustrated in the figures below.

Private Protection

Because Floating Rate Direct Loans require borrowers to pay higher interest as rates increase, credit risk is the most prevalent and important risk to manage.

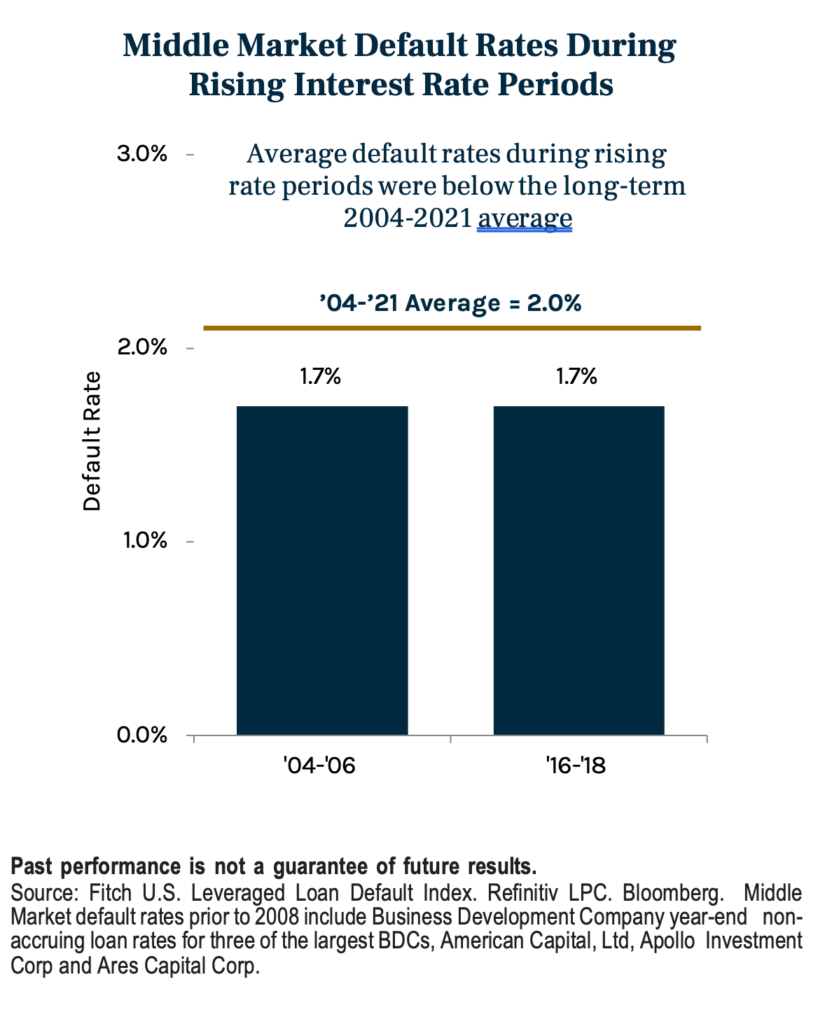

In our analysis of the last two of the Fed’s rate tightening cycles, we observed very limited impact to direct loan default rates during these periods.

Fundamentals Matter

These low default rate trends are due largely to relatively strong underlying economic and corporate fundamentals. The Fed is typically tightening monetary policy when the economy is exhibiting stronger fundamental trends.

During these two periods of rising interest rates, default rates of middle market companies have averaged below the long-term average annual default rate. This is largely attributable to improving economic fundamentals, which muted the impact of a gradual rise in interest expense on interest coverage ratios.

Careful Covenants

In addition to strong fundamentals, private credit investors are protected by lending practices and documentation, which is arguably more stringent than those found in the syndicated loan or high yield markets. In the past, it has been difficult for the Fed to engineer a soft landing (i.e., no recession) after a rate tightening cycle. While a recession is a possible scenario during the current tightening cycle, we believe middle market direct lending assets remain well positioned relative to other public market assets (stocks, bonds, etc.). This is due to their seniority in the capital structure, covenant protections and long-term, flexible capital that often enable the lender to mitigate defaults during periods of credit deterioration. We break this down even further below:

- Position in Capital Structure. Last year, over 90% of private credit loans were structurally senior secured loans, meaning the company would have to experience significant deterioration in value before it compromises the loan repayment.

- Tighter terms. Private loans often have covenants, including a financial maintenance covenant, typically a leverage covenant. These are considered important as they permit lenders to “get to the table” early and proactively address problems with the company before they become a crisis, ultimately protecting the investor.

- More robust underwriting and monitoring. Private credit lenders invest in the loan with the intention of holding it to maturity, not repackaging and selling to others. Therefore, they are more likely to conduct more extensive business and legal diligence before investing in the company. Additionally, they may actively monitor the performance of the company.

- Aligned motivations. Most private credit loans are made to private-equity-sponsor-backed non- public companies that have deep relationships with their lenders, which is important in a troubled loan situation. As private lenders likely represent a borrower’s most senior creditors, they are motivated to ensure the borrower’s business survives and the loan is repaid.3

While never fully mitigating credit risk, the combination of greater control over terms and access to non-public creditor information provides a sourcing and pricing advantage. This can add a measure of investor protection from default.4

3 Source: Proskauer Insights Report 2021.

4 References to “downside protection” or similar language are not guarantees against loss of investment capital or value.

NOT Paying the Price

More Price Stability

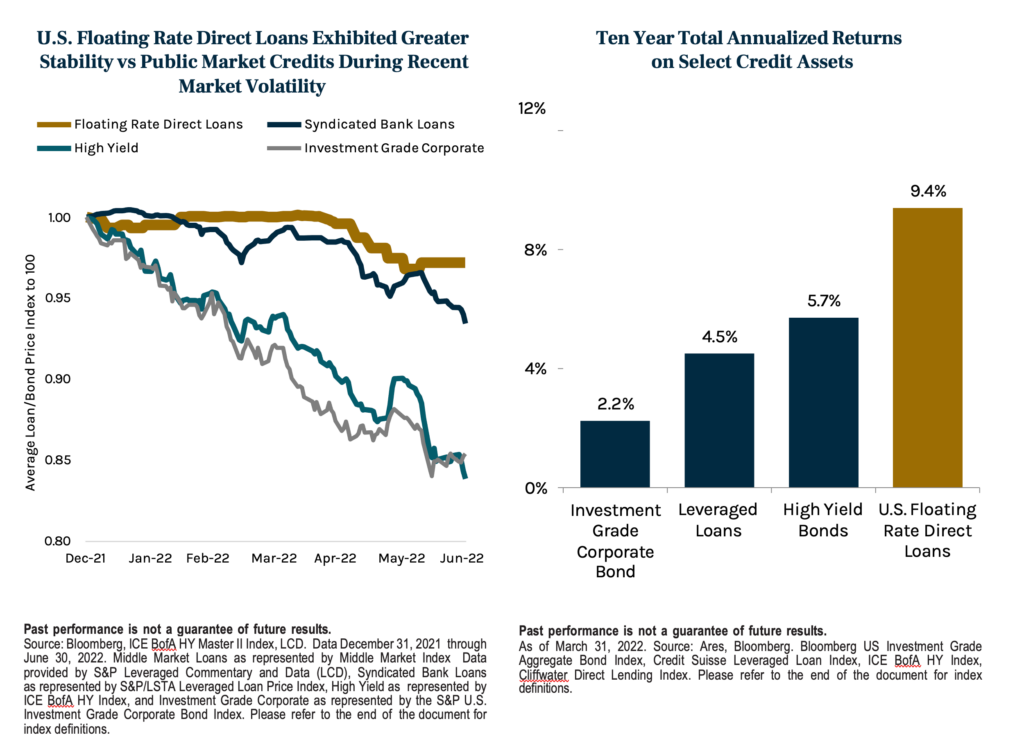

Once the loans are made and the debt is issued, it is largely owned by institutional investors. This type of investor base generally buys the debt as a longer-term investment and will hold it until maturity, not trading frequently. As a result, private credit typically exhibits greater price stability than public market equivalents, as demonstrated by the chart below (gold line vs. others). Due to the sharp rise in treasury rates, fixed rate, long-term assets such as high yield bonds and investment grade corporate bonds have experienced more significant price volatility with year-to-date returns of -14.0% and -14.4%, respectively.5

Price Point

In addition to greater price stability, Floating Rate Direct Loans have consistently generated higher coupon yields compared to high yield bonds, bank syndicated loans and investment grade corporate bonds largely due to the illiquid nature and proprietary sourcing and structuring of the assets. By combining higher coupons, larger structuring and prepayment fees, low credit loss rates and relatively stable asset prices, Floating Rate Direct Loans have generated superior total returns over the past decade, as shown in the below.

5 Source: As of June 30, 2022.

Conclusion

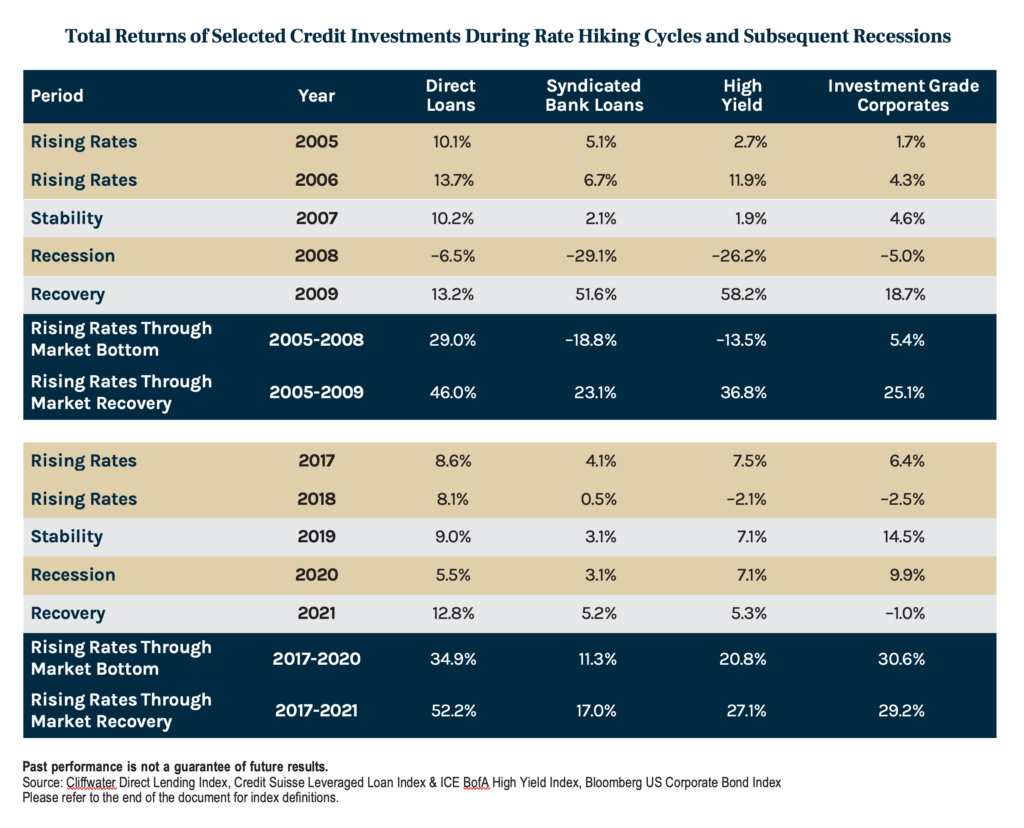

Putting this together, an analysis of Cliffwater’s Direct Lending Index returns highlights that Floating Rate Direct Loans outperformed other credit market alternatives such as syndicated bank loans, high yield bonds and investment grade corporate bonds during the last two of the Fed’s rate tightening cycles (2005- 06 and 2017-18). Direct lending returns also held up relatively well when the economy subsequently slipped into a recession following the Fed tightening cycles. When reviewing the full business cycle, including the period of rising rates and the subsequent recession and declining rate period followed by the recovery, the Floating Rate Direct Loans outperformed by a significant margin in both the 2005-2009 cycle and again in the 2017-2021 cycle.

Based on their attractive characteristics – floating rate coupons, strong structural protections and price stability – we believe Floating Rate Direct Loans have the ability to outperform in the current interest rate hiking cycle and related market volatility.

INDEX DEFINITIONS

- The ICE BofA US High Yield Master II Index (“H0A0”) tracks the performance of US dollar denominated below investment grade corporate debt publicly issued in the US domestic market. Qualifying securities must have a below investment grade rating (based on an average of Moody’s, S&P and Fitch), at least 18 months to final maturity at the time of issuance, at least one year remaining term to final maturity as of the rebalancing date, a fixed coupon schedule and a minimum amount outstanding of $100 million. Index constituents are capitalization-weighted based on their current amount outstanding times the market price plus accrued interest. Accrued interest is calculated assuming next-day settlement. Cash flows from bond payments that are received during the month are retained in the index until the end of the month and then are removed as part of the rebalancing. Cash does not earn any reinvestment income while it is held in the index. The index is rebalanced on the last calendar day of the month, based on information available up to and including the third business day before the last business day of the month. No changes are made to constituent holdings other than on month end rebalancing dates. Inception date: August 31, 1986.

- The Credit Suisse Leveraged Loan Index (“CSLLI”) is designed to mirror the investable universe of the $US-denominated leveraged loan market. The index inception is January 1992. The index frequency is daily, weekly and monthly. New loans are added to the index on their effective date if they qualify according to the following criteria: 1) Loan facilities must be rated “5B” or lower. That is, the highest Moody’s/S&P ratings are Baa1/BB+ or Ba1/ BBB+. If unrated, the initial spread level must be Libor plus 125 basis points or higher. 2) Only fully-funded term loan facilities are included. 3) The tenure must be at least one year. 4) Issuers must be domiciled in developed countries; issuers from developing countries are excluded.

- The S&P/LSTA Leveraged Loan Index (“S&P LSTA LLI”) reflect the market-weighted performance of institutional leveraged loans in the U.S. loan market based upon real-time market weightings, spreads and interest payments. Facilities are eligible for inclusion in the index if they are senior secured institutional term loans with a minimum initial spread of 125 and term of one year. They are retired from the index when there is no bid posted on the facility for at least 12 successive weeks or when the loan is repaid.

- S&P U.S. Investment Grade Corporate Bond Index – The S&P 500 Investment Grade Corporate Bond Index, a subindex of the S&P 500 Bond Index, seeks to measure the performance of U.S. corporate debt issued by constituents in the S&P 500 with and investment -grade rating. The S&P 500 Bond Index is designed to be a corporate-bond counterpart to the S&P 500, which is widely regarded as the best single gauge of large-cap US equities.

- The S&P Leveraged Commentary & Data (“S&P LCD”) Middle Market Index reflects data and analysis on U.S. loans for issuers typically generated

$50 million of EBITDA or less collected by S&P Global Market Intelligence.

- Cliffwater Direct Lending Index (CDLI) seeks to measure the unlevered, gross of fee performance of U.S. middle market corporate loans, as represented by the asset-weighted performance of the underlying assets of Business Development Companies (BDCs), including both exchange-traded and unlisted BDCs, subject to certain eligibility requirements.

IMPORTANT INFORMATION

This content, developed by Ares Wealth Management Solutions LLC, is for informational purposes only and should not be used as a primary basis for investment decisions and is not intended to serve as impartial investment, fiduciary, legal or tax advice. This is not an offer or solicitation to invest in any product.

Private securities investments carry many risks including the risk of substantial loss of part or all of an investment. This material does not take into account any specific objectives or circumstances of any particular investor, or suggest any specific course of action. Individual investors should consult with their financial advisor when considering any investment.

The views expressed in this letter are those of the author(s) as of the date of this content. Ares has no obligation to provide updates on the subject in the future and the views expressed herein are subject to change. Moreover, while this letter expresses views as to certain investment opportunities, Ares may undertake investment activities on behalf of one or more investment mandates inconsistent with such views subject to the requirements and objectives of the particular mandate. Ares and its affiliates cannot guarantee the accuracy or completeness of any statements or data contained in this material.

These materials also contain information about Ares and certain of its personnel and affiliates whose portfolios are managed by Ares or its affiliates. This information has been supplied by Ares to provide finance professionals with information as to its general portfolio management experience.

This communication may contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Statements other than statements of historical facts included in this communication may constitute forward-looking statements and are not guarantees of future performance or results and involve a number of risks and uncertainties. Actual results may differ materially from those in the forward-looking statements as a result of a number of factors, including those described from time to time in filings with the U.S. Securities and Exchange Commission. Ares undertakes no duty to update any forward-looking statement made herein. All forward-looking statements speak only as of the date of this communication.

This may contain information obtained from third parties, including ratings from credit ratings agencies such as Standard & Poor’s. Reproduction and distribution of third-party content in any form is prohibited except with the prior written permission of the related third party. Third party content providers do not guarantee the accuracy, completeness, timeliness or availability of any information, including ratings, and are not responsible for any errors or omissions (negligent or otherwise), regardless of the cause, or for the results obtained from the use of such content. THIRD PARTY CONTENT PROVIDERS GIVE NO EXPRESS OR IMPLIED WARRANTIES, INCLUDING, BUT NOT LIMITED TO, ANY WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE. THIRD PARTY CONTENT PROVIDERS SHALL NOT BE LIABLE FOR ANY DIRECT, INDIRECT, INCIDENTAL, EXEMPLARY, COMPENSATORY, PUNITIVE, SPECIAL OR CONSEQUENTIAL DAMAGES, COSTS, EXPENSES, LEGAL FEES, OR LOSSES (INCLUDING LOST INCOME OR PROFITS AND OPPORTUNITY COSTS OR LOSSES CAUSED BY NEGLIGENCE) IN CONNECTION WITH

ANY USE OF THEIR CONTENT, INCLUDING RATINGS. Credit ratings are statements of opinions and are not statements of fact or recommendations to purchase, hold or sell securities. They do not address the suitability of securities or the suitability of securities for investment purposes and should not be relied on as investment advice.