The typical self-directed investor today, even one using a basic free brokerage app, has access to investment vehicles that once would have been exclusive to large institutions and their representatives. With a few clicks, the investor can gain exposure to global diversification and advanced strategies to build relatively complex portfolios at little cost and low investment minimums.

This is in no small part due to the rapid rise of exchange-traded funds, which numbered fewer than 300 two decades ago but today represent more than 600 issuers together managing more than 10,000 funds. From their days passively tracking only the broadest indices, ETFs have proliferated to offer every investment style on the market.

ETFs and the democratization of market access they have fostered have likely caused some handwringing over the years among professional financial advisors. But since crashing the gates of financial markets, ETFs have proved a valuable tool for advisors rather than being a source of industry disruption. Here are three key takeaways about advisor ETF usage from InvestmentNews’ ongoing investment outlook survey.

ETFs EMERGING AS PORTFOLIO CORE

Although billions of dollars in assets have been converted from mutual funds to ETFs in recent years, mutual funds remain a common building block for client portfolios. According to our survey, 31% of advisors most commonly employ mutual funds in portfolio construction, compared to 28% using ETFs. Both exceed the number of advisors primarily using individual securities (20%) and separately managed accounts (18%).

The data suggest, however, that the prevalence of ETFs in professionally constructed portfolios will increase in the coming years. Asked about shifting holdings from mutual funds to similar ETFs, 44% of advisors said they were very likely to do so in the next two years, and an additional 32% said it was somewhat likely. Over the next year, 44% of advisors expect to increase client exposure to at least one type of ETF, while only 30% expect to increase exposure to at least one type of mutual fund.

This trend reflects the common advantages associated with ETFs. Asked to name the top three benefits of using ETFs, advisors cited lower expenses (81%), tax efficiency (58%) and daily liquidity (48%). These are oft-discussed benefits of ETFs over mutual funds that are rooted in the structures of the vehicles. But perhaps the most interesting indication of ETFs’ growing popularity with advisors is demand for ETFs in active management, where mutual funds have historically held an advantage. Over the next year, 34% of advisors plan to increase their usage of actively managed ETFs, up from 18% of advisors a year ago, while 2% expect to decrease usage. Only 23% of advisors expect to increase allocations to actively managed mutual funds, and 14% expect to decrease them.

CLIENTS ARE HIGHLY RECEPTIVE TO USING ETFs

Advisors who increasingly prefer to use ETFs as portfolio building blocks have found an approving audience among their clients. According to 78% of advisors, the typical client is very receptive to using ETFs in their portfolio, and only 2% of surveyed advisors reported significant pushback. Likely clients easily grasp the cost benefits that have driven their advisors’ recommendations.

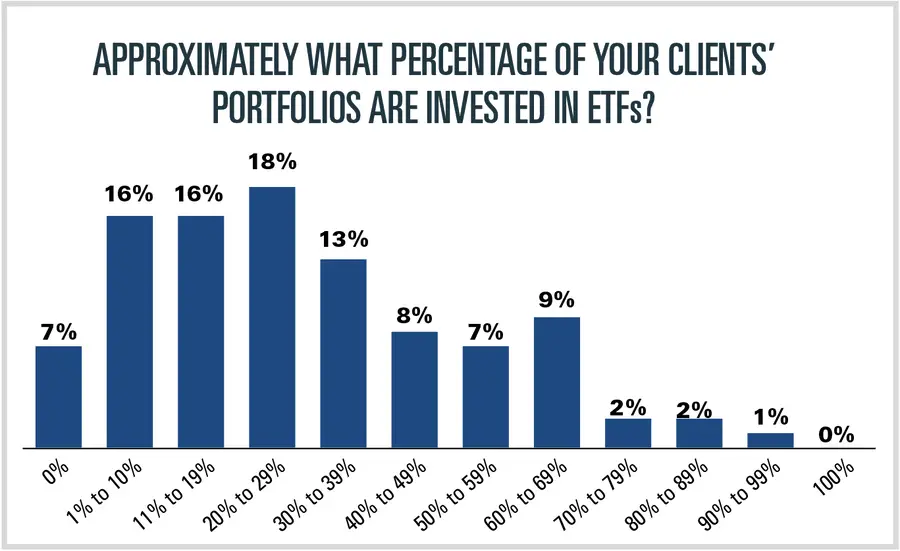

Clients’ embrace of ETFs is also reflected in the extent to which their assets have been invested in the vehicles. About one-fifth (21%) of advisors reported that a majority of their clients’ assets are invested in ETFs. Among all advisors — not just those using them — the median allocation to ETFs in client portfolios is in the range of 20% to 29%.

Although actively managed ETFs are growing in popularity, especially relative to mutual funds, index-tracking products remain the most commonly used ETFs both in the broader market and among advisors. Most advisors are also using sector- and factor-specific ETFs. Even among advisors using ETFs, few employ thematic, leveraged or inverse ETFs in their clients’ portfolios.

ADVISORS DON’T VIEW ETF INVESTING AS A THREAT

Just as advisors have steered their clients through mutual fund selections, clients seek help from their advisors with ETFs. And though the latter are perhaps easier to access without the aid of a financial professional, the industry is scarcely worried that their increased prevalence will undermine business.

Asked about the potential that ETF investing would ultimately reduce demand for professional advice, 53% of respondents to our survey said they were not very concerned and 23% said they were not concerned at all. Only 2% of advisors said they were very concerned about such a possibility. Advisors are confident overall that their role in helping consumers navigate investments will endure with ETFs.

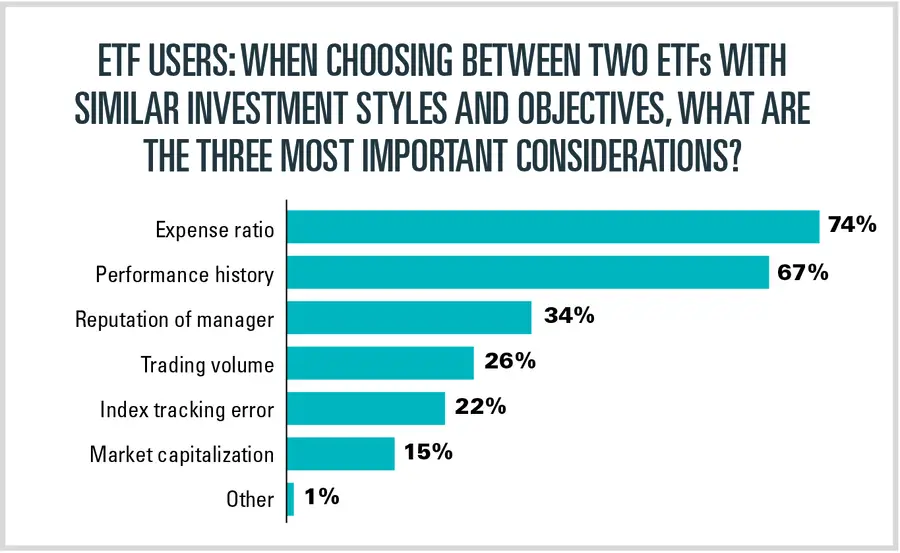

Perhaps unsurprisingly, advisors by a wide margin view expenses as a top factor in ETF selection. When selecting between two funds with similar investment styles, expense ratios are a top consideration for 74% of advisors, most closely followed by performance history, with 67%. Manager reputation and trading volume are top factors for roughly one-third and one-quarter of advisors, respectively, while the fund’s tracking error and market capitalization are less important factors.

[More: BlackRock tries again at target-date ETFs]