Last year was a lot like a Sunday evening — pleasant and satisfying, but with the clear and gathering notion of hard work ahead. Losses in the financial markets and continued inflation created the expectation over the year that dire times may be on the horizon. As a result, we saw a year of profitability, but also one of cautious spending and hiring.

The results of the 2023 InvestmentNews Advisor Benchmarking Study not only provide a benchmark for firms that have business characteristics similar to those of the participants, but also an opportunity to examine the forces shaping the results and the strategies and tactics employed by advisory firms in the pursuit of faster growth and better profitability.

CHANGES IN ASSETS AND CLIENT RELATIONSHIPS

The fortunes of financial advisory firms are closely linked to the returns on investment generated by financial markets, and it is therefore no surprise that 2022 was a year of declining assets under management.

The firms participating in the 2023 study saw the assets they manage on behalf of their clients decline by an average of 7.4%. By comparison, the S&P 500 Index total return declined 18.1% over the year. The strong correlation between the two is evident, and anyone with experience in the industry will find that relationship to be logical and perhaps inevitable. Still, long-term success for an advisory firm means finding ways to do a little bit better than what the financial markets would deliver.

The quarterly billing of advisory fees substantially mitigated the overall revenue effect of the decline in assets. In fact, the firms in the study experienced a 5.0% median increase in revenue in 2022. This is because the first quarter of 2022 was most often billed to clients on Jan. 1, when the markets were still near their high points. More firms bill their clients at the beginning of the quarter than at the end. The same is true for subsequent quarters — the decline in AUM was gradual, and this created a lag effect that shielded revenue. Unfortunately, this means that revenue recovery will also lag as financial markets begin growing again.

The markets not only define investment returns, but heavily influence the overall interest that consumers have in investing and in engaging trusted professionals to help them. It is certainly true that while consumers go to the doctor when they feel poorly, they go to the financial advisor when they do well.

On average, the advisory firms in the study added a net 51 new clients, for an average of 8.0% growth in their client relationships. This could be seen as an outstanding result, but we do need to consider the sources of growth before reaching that conclusion. The averages don’t always tell the full picture, as they tend to disguise the extremes.

The typical firm made no acquisitions and was therefore limited to organic growth, while a small cadre of mostly very large firms participated actively in acquisitions, accelerating their own growth, but at a very steep price.

In 2022, an average 17 clients per firm were lost and 37 per firm were added through organic growth, resulting in a net average of 20 new client relationships, or 3.1% growth — a relatively modest result in terms of historical growth and the expectations of most firms. An additional average 31 clients were gained through mergers and acquisitions (or through hiring a new advisor who brought existing clients with them), resulting in large gains in client relationships for the minority of firms that participated in mergers or acquired other firms.

GROWTH DYNAMICS

The net average decline of 7.4% in AUM was influenced the most by an average 11.0% loss due to market performance. Firms also experienced an outflow of 2.2% in assets from clients who left. Notably, many clients who leave an advisor do not hire a new advisor, and instead choose to manage their own finances, according to surveys by the Ensemble Practice. Thus, the loss of clients by one firm may not actually create opportunities for other firms.

Firms also lost 3.6% of assets to distributions — cases in which the client still works with the advisory firm but chooses to remove some of the assets from their management either to use them as income (e.g., in retirement), make large purchases or simply convert the investments into cash. Some advisory firms do not charge fees on cash held by clients in their advisory accounts. By comparison, distributions reduced AUM by 2.3% in 2021, when the stock market was generating great returns. In general, it is safe to assume across the industry that outflows accelerate during bear markets. But this may not always be true: Some firms include cash and liquid assets in their definition of billable assets, and many firms encourage their clients to stay invested in down markets.

As Warren Buffet famously said, “Be fearful when others are greedy and greedy when others are fearful.” Many clients must have followed this philosophy, as contributions added 3.7% to average AUM. Existing clients also continued to refer new potential clients to firms, and that referral activity created 1.8% growth in AUM. For comparison, in 2021, client contributions added 5.2% to AUM, and their referrals resulted in 3.1% growth. Much as with outflows, it is safe to assume across the industry that the rate of referrals declines for most firms in bear markets.

Mergers and acquisitions emerged as some firms’ secret ingredient for growth. M&A activity created 1.9% growth on average, inclusive of the recruiting cases in which firms were able to attract an advisor who also brought clients from their prior firm. However, this type of growth was the privilege of a select few: Only 9.5% of participants reported AUM inflows from M&A activity, and the majority of such firms were in the largest size category, with over $1 billion in AUM — what we term “super ensembles.”

The decline in assets over the course of 2022 created a stormy sky that advisory firms could see from miles away. The lagging effect on revenue created by the billing process gave advisory firms time to prepare for the challenges to come, but damage to profitability seemed and continues to seem inevitable.

PROFIT MARGINS AND OWNER INCOME

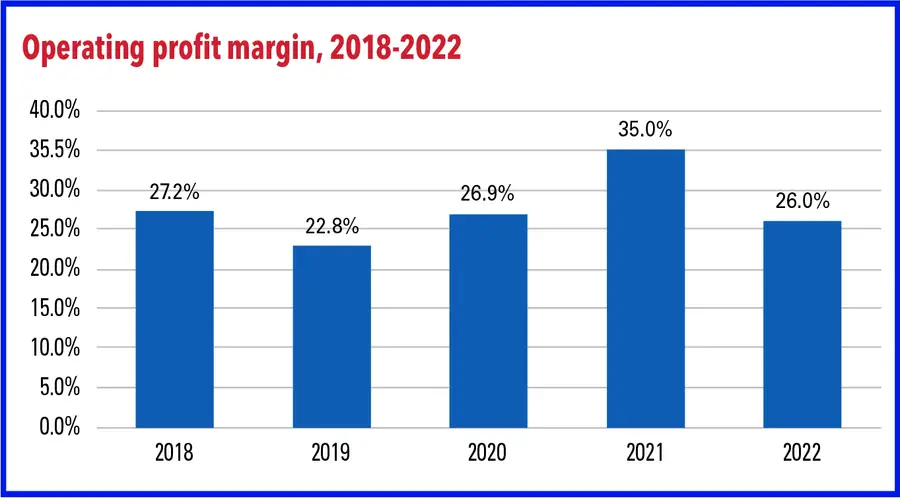

On average, 2022 still brought great profitability to independent advisory firms, but it also clearly signaled that the high profit margins of 2021 were unsustainable and perhaps will never be seen again. The average advisory firm in the study had a profit margin of 26.0% in 2022, and the median firm had a profit margin of 25.0% — a good result by historical standards but spoiled by the foreboding decline in AUM.

The largest firms in the survey, those with more than $1 billion in AUM, had a median profit margin of 25.4%. Midsize firms with AUM between $500 million and $1 billion had a profit margin of 26.0%, and small ensembles with under $250 million in AUM had a profit margin of 21.8%.

Solo firms, those with only one advisor, had a median profit margin of 33.0%. It is difficult to compare the profit margin of solo firms to that of larger organizations, primarily due to the differences in how they account for the compensation of the only advisor/owner. While larger firms typically pay market-level compensation to their owners, solo firms are often sole proprietors who combine their compensation and profit into a single stream of income.

On average, advisory firms generate 42.5 cents of income for their owners for every dollar of revenue. Income may be the most simplistic measure of financial success: It simply represents what the owners collectively take home after all the bills are paid. It does not reflect the cost of the owners’ own labor, but it is also immune to some of the distortions that owner compensation can create. For that reason, some acquirers use earnings before owner compensation, or EBOC, in their valuations, deal structures and management decisions.

All ensembles had the same EBOC margin of 42.2%; only solo firms were different, with 70.9%.

The past year challenged advisory firms to shepherd their clients through the losses of the financial markets and the anxiety of inflation, while finding the right way to manage their own resources in anticipation of declines in revenue and increases in cost. The industry environment was the same for all participants in the study, but the outcomes were not always identical — good firms found a way to defy the challenges, even if by a small amount. Still, we are clearly witnessing a transformation in how the advisory community operates and competes. The past five years have given us some of the highest profit margins ever seen, and the steepest increases in owner income. The result is a sense that the standards for financial success and fair compensation are changing as we speak.

For access to the full report and dashboard, click here.