Meme stocks aren’t the only way for investors to secure quick profits

Subscribers to Chart of the Week received this commentary on Sunday, May 19.

The past few weeks for investors have been rewarding, with the broader market offering up weekly wins across the board last Friday. The Dow Jones Industrial Average (DJI) marked its best week of 2024, rattled off its longest win streak (eight days) since July 2023, and this past Thursday topped 40,000 for the first time ever. The Dow’s outstanding month meant several impressive profits for Schaeffer’s subscribers, including two blue-chip picks that more than doubled investor money.

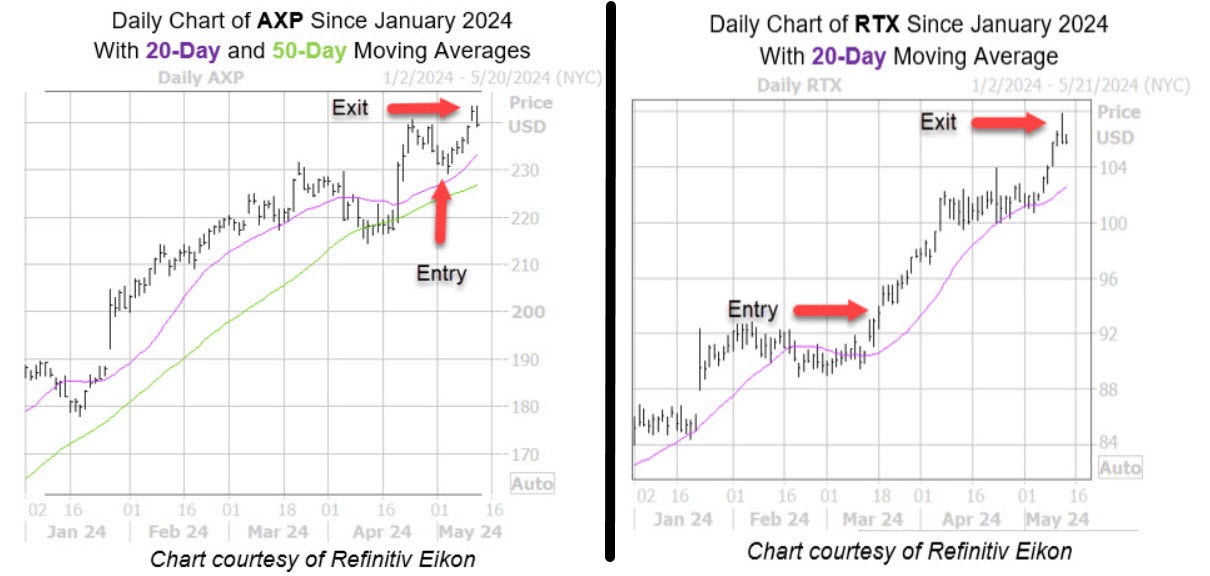

This past week, Digital Content Manager Fernanda Horner reviewed our American Express Company (NYSE:AXP) and RTX Corp (NYSE:RTX) trades, which each pulled in subscribers an 111% and 207% profit, respectively. The former was featured for our In-The-Money Countdown product, while the latter came from our Weekend Player subscription. Depending on your trading preferences and comfortability with risk, we enjoy seeing both short- and long-term trading products yield impressive results.

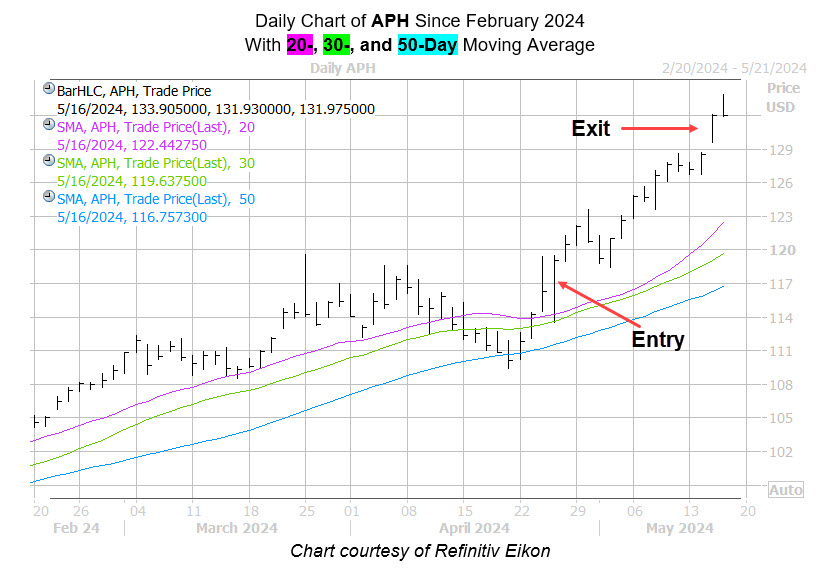

In the span of two trading days though, it’s time to upgrade the leaderboard. Our flagship pioneer product, the Option Advisor newsletter, just churned out a big winner with fiber optics name Amphenol Corporation (NYSE:APH) in our May newsletter. Prior to our recommendation on Friday, April 26, APH had pulled back to its 50-day moving average, but that week – thanks to a first-quarter earnings and revenue beat — had rallied to clear a confluence of the rising 20- and 30-day trendlines and sent the stock above their March through April highs. APH was trading at a record high, but amid this rally shorts had more than doubled their positions setting up a potential short squeeze in May.

Fresh off clearing the technical hurdle, the shares promptly rattled off 9 wins in the next 14 trading days, bouncing off their ascending 50-day moving average. In response to the positive post-earnings reaction that also featured a share buyback program, bull notes flooded in, with the stock’s average 12-month price target of $129.64 now just below current levels.

After 14 days of market trading, this past Wednesday, May 15, APH climbed to its then, record high of $132.08, locking in a 111% profit for our July 115-strike call.

As Wall Street was once more captivated by the return of meme stocks in the past week, the three postmortems we just unpacked above serve as a reminder that investors can snag quick, outsized moves without chasing trends and rampant speculation. While trading options certainly entertains tender risk, this is a more common cycle of market trading as opposed to the smash-and-grab nature of meme stocks.